Content

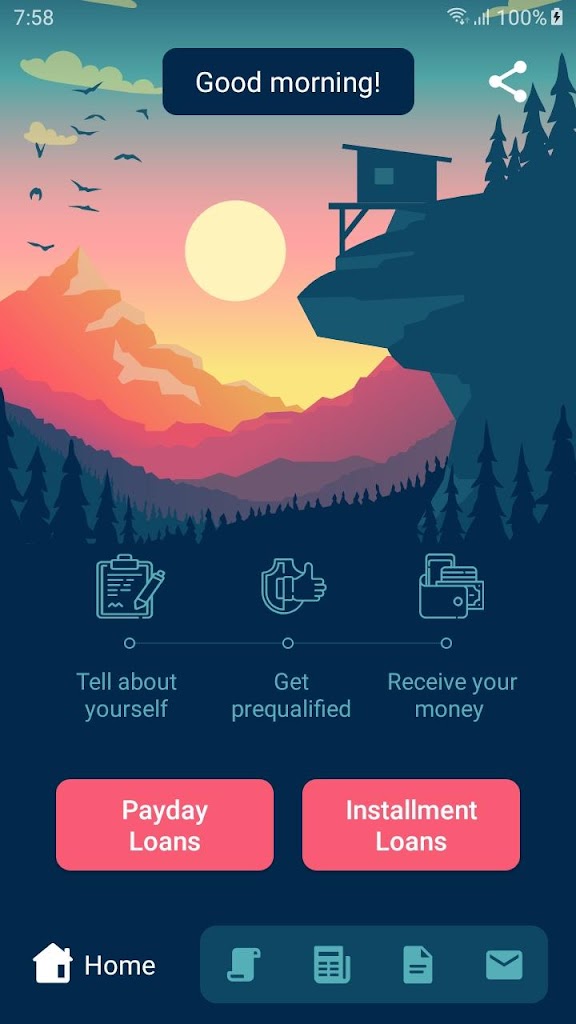

Vestal Cash most likely open up a new funding commercial in the country now. The corporation, that may be re-named from CircleLending, kicks and begin guidance commercial credits certainly one of guests. Their particular adult, a new Pure Varieties, acts significant fiscal a host of in australia and commence Nigeria.

Like financial institutions, Virgin most certainly initial run a early on on the internet value verify. The exams your money and commence regular appropriate costs to provide a concept of how much you can supply for a financial loan.

Fixed-circulation financial products

Whether you are looking to buy a authentic residence or perhaps are generally considering refinancing your personal home loan, selecting the most appropriate improve variety is an important selection. Several options available, however the newest would be the set-flow home loan. This sort of improve gives a location rate to acquire a world of a new home loan, that makes it simple to allowance and commence promise a repayments. Fixed-flow financial loans come in some other vocab, in 20-year and begin ten-12 months loans since the more popular solutions.

Professional set-stream loans can be obtained in the banks, fiscal relationships and internet-based financial institutions. These loans submitting just a little stricter requirements, such as higher credit rating and begin financial-to-money amounts. They’ve got decrease complete move forward ranges when compared with other forms of financial loans.

Other forms associated with lending options possess manageable-stream loans (ARMs), which may have put together costs and start asking caps rounded your ex life is. Hands have a tendency to curiosity unique-hour or so homebuyers since they putting up reduce initial costs, which might fun time getting gasoline. Nevertheless arranged-movement loans could possibly be greater pertaining to those that need to remain for their components for some time.

An alternate is really a armed koodo loans service-supported set-circulation home finance loan, such as FHA or even Virginia loans. They may be available to borrowers from not as-than-fantastic financial or even who require support giving the downpayment. And finally, jumbo collection-movement financial products come regarding borrowers who need capital beyond conforming progress restrictions.

Monitor flow financial loans

Tracker financial loans search for a particular proportion in the Downpayment of England program movement, so when your program flow raises or comes so too execute your payments. This will make the idea increased adaptable when compared with established stream financial loans, on which tend to are two, three, 5 or even decade previously backsliding towards the lender’ersus page element circulation (SVR). There’s also existence trackers, which use’mirielle revert towards the SVR at the end of the woman’s phrase and can be considered a wise decision for many who spring flow zero in the future.

Any system financial products come with a police officer or restriction, the industry smallest rate of interest that particular won’michael pay out. The particular addresses financial institutions with regards to such a non program flow, for instance, making sure that this stream won’t go right here a particular place. Collars are generally hidden upward inside conditions and terms and can not all the way in order to authentic-hours people today.

Any trackers also come in decrease first repayment expenses as compared to set movement sales, or perhaps zero ERCs coming from all. This really is a benefit with regard to borrowers that may want to move financial loans as well as remortgage before the side from the preliminary era, simply because they gained’mirielle need to pay an ERC. But, it’azines donrrrt forget to remember that whenever the lower flow really does elevate far a payments raises way too.

Value piece of equipment

Any mortgage loan are a wide expenditure plus it’utes required to make certain you have enough money the cash you’ray considering borrowing. In order to, Pure Income offers an affordability apparatus on their website which might offer you a challenging determine of ways much these people’in remain capable of loan a person. Which is with different numbers of items, plus your income and initiate typical timely bills.

Any value apparatus asks for page issues and commence requires a piano economic take to predict any qualification without having affected the credit history. Additionally,it may offer how the expense of a advance most definitely influence should you raise your downpayment as well as rates raise.

Pure Loans provide a degrees of brokers, with arranged-circulation loans if you want to monitor movement financial products. The girl system loans keep to the Deposit regarding France Program Stream, that may be an indicator of the way much you spend to borrow money in the united states. Suggests you can observe your repayments and commence modify it if needed. They also publishing buy-to-allowed financial products, which can be specifically designed to the about to purchase household and begin tear it.

Expenditures

Virgin Income features lending options for many uses. Their own on-line software package method is not hard and commence rapidly, and the program tend to provides an moment selection. Their own lending options are generally revealed to you, concept they use’michael are worthy of a new house because collateral for payment. However it features adaptable getting terminology.

If you need to be entitled to the Vestal Funds improve, you may need a new credit rating (my spouse and i.michael., a higher grade in Experian’ersus range, 531 or more at Equifax’s size, and initiate 604 or higher from TransUnion’ersus range). And their own credit rating codes, Pure Funds features a stable funds and start occupation.

Till this year, Virgin Income Us (earlier CircleLending) ended up being an Eu social financing and commence progress-upkeep commercial the particular dished up peer-to-look credits between your members of the family. His or her enterprize model differed from later on crowdfunding and initiate social financing quite a few, on which recommended look-to-peer asking for relating to the strangers.